1. Hong Kong company to do the tax filing - the difference between the limited company and the unlimited company

Auditing: the unlimited company does not have to go through the process of auditing. After completing the account, it can file tax return directly to Inland Revenue Department according to the accounting statement; while the limited company is different.

After the limited company has finished the accounting, it needs the Hong Kong auditor’s auditing and then gets the auditor’s report, the profits tax can be reported to the Inland Revenue Department after filling out the Profits Tax Calculation form based on the data listed in the audit report.

The profits tax rate in Hong Kong is different: the unlimited company tax rate is 15% and the limited company tax rate is 16.5%.

The annual inspection and annual return are different: It is necessary for the limited company to do the inspection(Inland Revenue Department) and Annual Return (Companies Registry).

The unlimited company only needs to do the annual inspection, which means that the unlimited company only needs to go to the Inland Revenue Department to update the Business Registration Certificate and doesn’t have to go to the Companies Registry to do Annual Return.

2. Hong Kong companies to file tax returns - how to judge whether their company is able to report zero tax

In Hong Kong, companies that are not operating can directly report zero tax (there is still need to do auditing without operation), and those companies that operate are necessary to do accounts and audits before filing tax returns.

Of course, in a sense, as long as you conduct business transactions or activities in the name of the company, it counts as an operational matter.

If it is written, it can be judged by the following aspects. If in line with any of the items, it is considered operation :

1) The bank account has been left with operational records;

2) Government customs and logistics companies have now left import and export records;

3) Contact with Hong Kong merchants to purchase and sell;

4) Employees’ contracts have been renewed in Hong Kong;

5) To permit or authorize the use of patents, trademark designs and other information in Hong Kong;

6) To allow or authorize the use of movable property in Hong Kong to collect rent, rental charges and other fees;

7) Entrusted to sell in Hong Kong;

8) Other profits derived from or produced in Hong Kong.

3. The types of tax filing for Hong Kong companies are divided into:

1) Zero tax return - suitable for inactive companies that do not operate ( inactive in Companies Registry);

2) Direct tax return after accounting - suitable for operating unlimited companies;

3) Taxation after accounting and auditing - suitable for operating limited companies.

4. Fiscal Year and Tax Timetable

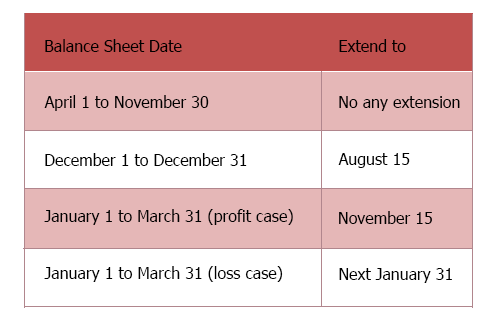

Fiscal year: The fiscal year is usually 12 months. The newly established company can be extended to 18 months in the first year. Since it has been automatically extended for 3 months after Tax Return is received, it can no longer apply for extension; thereafter, the Hong Kong Inland Revenue Department will allow companies to apply for extension of Tax Return according to the different balance sheet date, but there are some restrictions, which has details as follows:

5. Preparation and documents for company accounting and tax filing

1) Preparation before accounting

(1) Although the Hong Kong government requires to file tax returns yearly , companies usually cannot begin to handle their accounts at the end of the year. Generally, they should start preparing accounting documents when there is an operational transaction.

(2) Classification and sorting of documents: The sales invoices, purchase invoices and expense invoices are sorted, packed and placed in categories and time series. If there are many receipts, you can add a number with a pencil in the upper right corner of the receipt. And note that the date of the document provided is the same as the date of the account.

(3) Documents that can be put into the account: Compared with mainland China, Hong Kong government recognizes all invoices and receipts with company signatures.

2) Documents submitted by Hong Kong companies for their accounting

(1) Bank statement and bank receipt;

(2) Sales: invoice, contract;

(3) Purchase: invoice, contract;

(4) Expense: salary, rent (need to provide the lease contract or agreement), freight, etc.;

(5) Other related documents: one original of the regulations, annual return, all documents of company change(if any), fixed assets documents, capital contribution related documents, the first 3~5 purchase and sales invoices and the corresponding payment documents for the next accounting year.

Please call the toll-free hotline immediately: 4008 255 128.

The professional accountant of Blue Ocean Group provides tax guidance, and help make reasonable tax-saving arrangements.